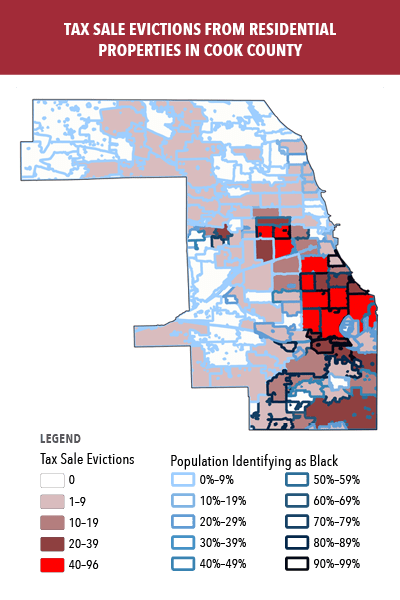

Analysis shows most tax sale evictions occur on south, west sides of Chicago and suburban Cook County.

For Immediate Release: November 15, 2021

Contact: Bob Palmer, Policy Director, Housing Action Illinois, bob@housingactionil.org or 312-939-6075

COOK COUNTY – A new report by Housing Action Illinois finds that tax sale evictions in Cook County disproportionately occur in majority-Black communities. In the 11 zip codes with the highest number of tax sale evictions, 73% of people identified as Black. By contrast, among the 44 zip codes with zero tax sale evictions, 82% of people identified as white.

The report analyzes 1,429 Cook County tax sale evictions between September 2010 and February 2020, comparing the zip codes where the evictions occurred to race and ethnicity data from the U.S. Census Bureau. More than 95% of the evictions were from residential properties—mostly single-family homes.

“A home is a valuable financial asset that can be passed on for generations,” says Sheila Sutton, Housing Policy Organizer at Housing Action Illinois. “Tax sale evictions contribute to the racial wealth gap by transferring wealth out of families and communities. Often, a person only owes a relatively small amount of actual property taxes, but the high interest rates, fees, and other charges add up to significantly increase that amount.”

In Illinois, state law requires counties to hold an annual tax sale for properties with delinquent property taxes from the previous year. If the property owner is unable to pay off the taxes in full—including interest, penalties, and fees—the tax purchaser can become the legal owner of the property and evict the current residents. Cook County’s 2018 Annual Tax Sale, which was rescheduled due to COVID-19, concluded on November 10.

“There are larger, systemic racial disparities in our property tax system, and this is reflected in the areas where tax sale evictions are concentrated,” says Bob Palmer, Housing Action’s Policy Director. “There are changes we can make to rebalance the system and help people maintain ownership of their homes or pay property taxes they’re struggling to afford.”

The report recommends exempting owner-occupied properties from the tax sale process when the amount of past-due taxes is low and the homeowner lacks resources to pay them, lowering the interest rates and fees that the tax purchaser can charge, and providing resources for homeowners struggling to afford their property taxes. The report also suggests exploring alternative models for owner-occupied homes with past due property taxes, such as putting a lien on the home and placing the property in a community land trust.

Read the full report: Racial Disparities and Cook County Tax Sale Evictions

Housing Action Illinois analyzed 1,429 tax sale evictions in Cook County between September 2010 and February 2020. The map above illustrates the number of tax sale evictions and percentage of the population identifying as Black in each zip code.

###

About Housing Action Illinois

Housing Action Illinois is a statewide coalition that has been leading the movement to protect and expand the availability of quality, affordable housing in Illinois for nearly 35 years. Our 160+ member organizations include housing counseling agencies, homeless service providers, developers of affordable housing, and policymakers. We bring everyone together to work toward our vision of an Illinois where everyone has a stable, good home.