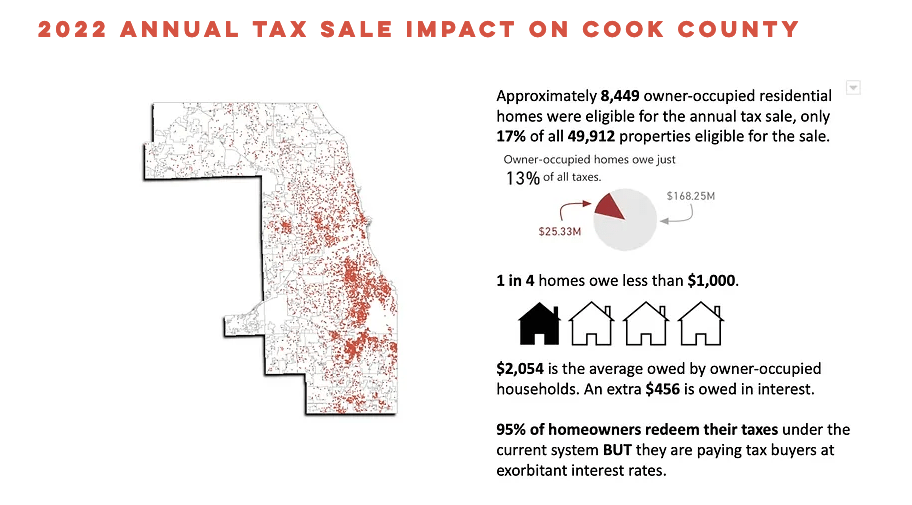

The inclusion of owner-occupied homes in the Cook County annual tax sale puts people, especially seniors and those with disabilities, at risk of losing their home solely for delinquent property taxes purchased by investors motivated by profit, without regard for the long-term impact on families and communities. Black and Brown homeowners and communities are especially negatively impacted, as the current system makes it harder for households to transfer wealth, contributing to the racial wealth and homeownership gaps.

This Bill (HB 1238/SB 74) helps families stay in their homes by

- Establishing a payment plan for homeowners to repay delinquent property taxes in Cook County

- Exempting all owner-occupied residential homes from the annual tax sale as long as taxpayers are in good standing with the payment plan

Thanks to our chief sponsors, Representative Debbie Meyers-Martin and Senator Robert Peters

This bill follows a trend towards reducing reliance on, or eliminating, the tax sale process, including in New York, Washington DC, Detroit, and Baltimore. Reducing the number of homes subject to the tax sale is a key step in addressing decades of disinvestment and stabilizing communities.

Organizations and individuals can endorse the effort. We encourage people to write a brief note explaining why you support this effort.