Lift the burden from the middle class.

Make the millionaires pay their share.

Low-income households now pay almost double what the wealthiest pay in taxes as a share of their income! That’s wrong—and it doesn’t raise enough revenue, pushing up property taxes and forcing harmful cuts to critical housing programs, education, human services, health care, infrastructure, public safety and jobs.

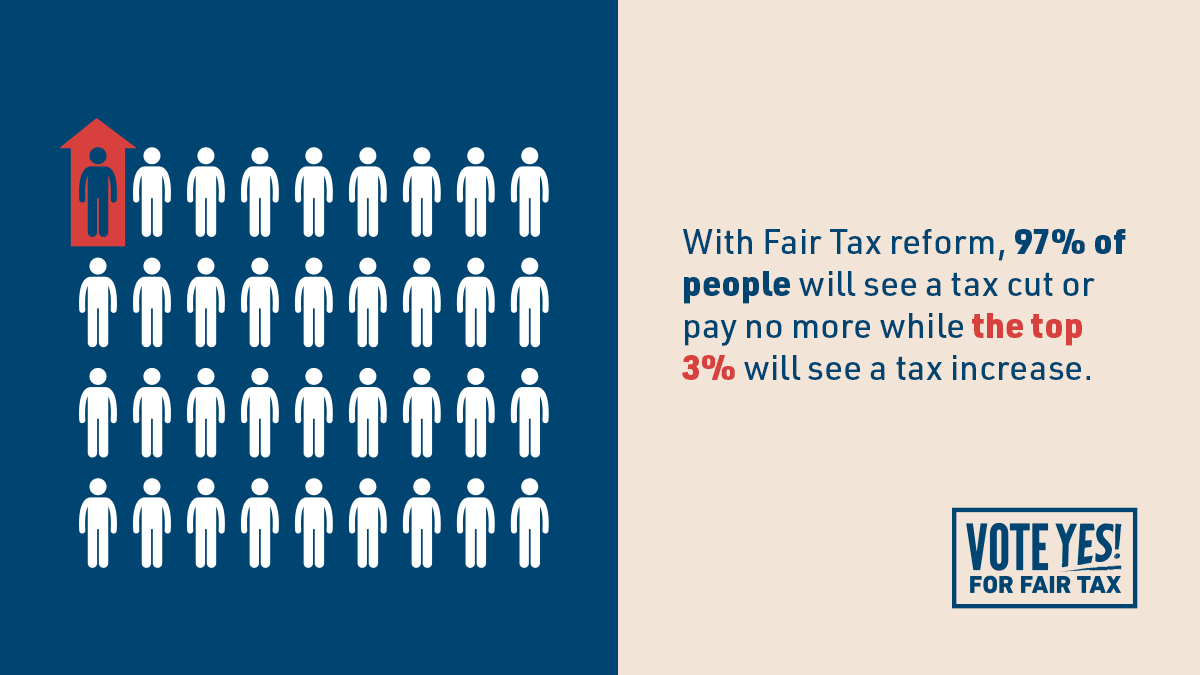

This November, Vote Yes for Fair Tax so Illinois can ask wealthy people (the top 3%) to pay a little more on income over a quarter-million dollars a year—while everyone else (97% of tax filers) gets a tax cut or pays no more—raising more than $3 billion a year to invest in shared priorities, such as ending homelessness and expanding affordable housing.

Join the fight for fairness

Everyone benefits from Fair Tax reform—but we can only win if everyone’s involved. Learn how you can help the Vote Yes campaign in your community! Together we can lift the unfair burden from the middle class, make it so the millionaires pay their share, raise revenue for schools and other priorities, and ease the property tax crunch.

Everything You Need to Know About the Fair Tax

Over the past several months, the Center for Tax and Budget Accountability has been compiling some of the most frequently asked questions about the Fair Tax and has created an FAQ to help voters understand the Fair Tax better.

The FAQ includes questions such as:

- What is the Fair Tax?

- How does the Fair Tax work?

- Why do we need the Fair Tax?

- How will the Fair Tax help the Illinois economy?