Renters must earn $19.98 to afford a two-bedroom apartment in IL, while nearly $225 million in emergency state funding for affordable housing is being held up to due to state budget impasse

For Immediate Release: May 25, 2016

For more information contact: Kristin Ginger, Communications Manager, Housing Action Illinois at kristin@housingactionil.org or 312-351-3042

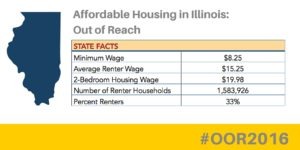

In order to afford a modest, two-bedroom apartment in Illinois, renters need to earn $19.98 per hour. This

is Illinois’ 2016 Housing Wage, revealed in a national report released today. The report, Out of Reach 2016, was jointly released by Housing Action Illinois, a statewide coalition that fights to protect and expand the availability of quality, affordable housing throughout Illinois, and the National Low Income Housing Coalition, a Washington, DC- based research and advocacy organization.

In order to afford a modest, two-bedroom apartment in Illinois, renters need to earn $19.98 per hour. This

is Illinois’ 2016 Housing Wage, revealed in a national report released today. The report, Out of Reach 2016, was jointly released by Housing Action Illinois, a statewide coalition that fights to protect and expand the availability of quality, affordable housing throughout Illinois, and the National Low Income Housing Coalition, a Washington, DC- based research and advocacy organization.

Nearly $225 million in state funding that would help alleviate the shortage of affordable housing was just included in a larger emergency funding bill for human service programs that the General Assembly recently passed with bipartisan support. The bill, SB 2038, includes funding for homeless shelters, supportive housing, rental subsidies, and housing construction. This funding—as well as additional funds for affordable housing—would have been available 11 months ago if not for the state budget impasse. On May 18, the bill was sent to Illinois Governor Bruce Rauner for his consideration.

“The state budget impasse has been causing people to become homeless. We urge Governor Rauner to help by signing the emergency spending bill,” says Bob Palmer, Policy Director of Housing Action Illinois. “This funding will provide temporary relief to homeless shelters that have had to turn away families and to developers building affordable housing who have had to delay construction on their projects.“

While state legislators have been locked in a budget stalemate, the average cost of rent and utilities for a two-bedroom apartment in Illinois has risen to $1,039 per month. In order to afford this without paying more than 30% of income on housing, a household must earn at least $41,567 annually. Assuming a 40-hour workweek, 52 weeks per year, this level of income translates into a Housing Wage of $19.98.

The minimum wage in Illinois is $8.25, which means a family must have more than two wage earners working more than full-time—or one full-time earner working 97 hours per week at minimum wage—to afford a modest two-bedroom apartment.

The cost of rental housing varies across the state, but there is no place in Illinois where a minimum wage worker can afford a two-bedroom apartment. Rental housing is the most expensive in the Chicago metropolitan area, where the Housing Wage is $22.62. In rural areas of Illinois, the average two-bedroom Housing Wage is $12.55.

“It’s an unacceptable situation,” says Housing Action Illinois Policy Director Bob Palmer. “Housing should be affordable enough that a family can pay rent and still put food on the table. Instead, minimum wage workers in our state face unaffordable rates whether they live in Chicago, Bloomington, or Cairo.”

While Illinois’ current budget stalemate is a unique situation, it isn’t alone in having a painfully high Housing Wage. Out of Reach finds that in no state, even those where the minimum wage has been set above the federal standard, can a minimum wage renter working a 40 hour work week afford a one-bedroom rental unit at the average Fair Market Rent.

Out of Reach provides the Housing Wage and other housing affordability data for every state, metropolitan area, combined non-metropolitan area, and county in the country.

For additional information, visit http://www.nlihc.org/oor.